Portfolio Considerations in a World where Stocks and Bonds move in the same direction.

What happened and why it is relevant?

The relationship between stocks and bonds, a key factor in constructing investors' portfolios and managing risk, has undergone a significant shift from negative to positive correlation. This change isn't entirely new; for much of the period before the last two decades, the correlation between these two asset classes was predominantly positive. The importance of this shift lies in the impact on portfolio risk: a negative correlation between stocks and bonds typically results in lower overall portfolio risk compared to a positive correlation. This dynamic has significant implications for risk management and necessitates adjustments in portfolio diversification strategies.

Over the past 20 years, investors have enjoyed a relatively straightforward approach to portfolio construction. Stocks and bonds not only offered positive expected returns but also provided substantial diversification benefits, along with liquidity. However, as market conditions evolve, investors must adopt a more nuanced and thoughtful approach to portfolio construction. This involves incorporating additional elements into their portfolios to enhance efficiency and adapt to the changing correlation between stocks and bonds.

Why it happened and is this permanent?

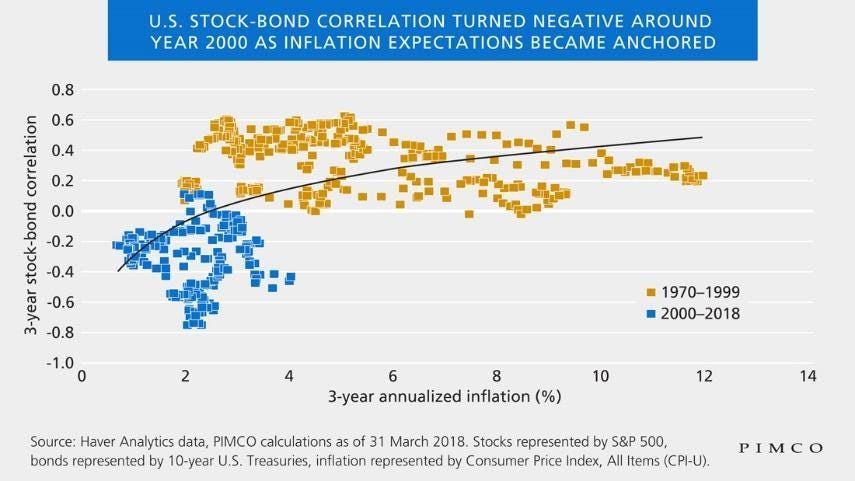

The primary factor influencing the relationship between stocks and bonds, as identified by many market experts, appears to be inflation. This includes both the uncertainty surrounding inflation and its influence on investor behaviour, as well as its general magnitude. Supporting this perspective, Pimco has provided an insightful graph. This graph below clearly illustrates the correlation between the level of inflation and the relationship between stock and bond markets, further affirming the impact of inflation on this dynamic.

The key insight here is that while higher inflation has a direct negative impact on Bonds, which is due to the expectations of higher interest rates to fight inflation. The relationship with stocks is a bit more complex with a negative impact only when higher inflation is not accompanied by expectations of increased economic growth.

Thus, the type of inflation plays a role in this dynamic. Inflation driven by increased demand may not lead to as strong a positive correlation between stocks and bonds as inflation driven by supply constraints. This supply-driven inflation adversely impacts both bonds and stocks making them move in the same direction.

This understanding offers a framework for considering the future relationship between stocks and bonds. The past two decades were marked by low inflation and a steady supply of goods and services. In contrast, a scenario with more limited supply could maintain higher inflation levels and shift the stock-bond correlation into positive territory. This perspective is relevant for anticipating and planning for potential changes in these market dynamics.

So, looking ahead, even though some analysts believe that Central Banks are making progress in their battle against inflation, there are still numerous challenges to consider. These include issues like fiscal deficits and the reshoring of industrial production. While these factors may not necessarily cause a resurgence in inflation, they contribute to maintaining a high level of uncertainty surrounding inflation trends making it challenging for stocks and bonds go back to the negative correlation experienced in the no inflation period from 2001 to 2022.

What are the implications for investors?

The relationship between stocks and bonds plays a crucial role in determining the overall risk of investment portfolios. Recent changes in this relationship are already influencing current portfolio risks, notably leading to an increase in the expected risk for a balanced portfolio as an example. To maintain the same level of risk as before, investors may need to decrease their equity allocations with the direct negative impact on the expected returns of these portfolios. This shift underscores the importance of adapting investment strategies to evolving market dynamics to manage risk effectively.

Beyond reducing portfolio risk exposure, another option is to add other elements to the portfolio that could improve portfolio diversification. A lot of investment advisors have presented the idea of private credit and private equity, but although these investments have their role in portfolios, they have limited ability to improve diversification as they share similar drives of returns and also add liquidity risk, which has a significant correlation to risk markets.

There are although some investment strategies that can provide diversification to the portfolios and keep the portfolio liquidity. These strategies are broadly know as liquid alternatives and fall into two categories, one that has a dynamic approach to its directional position to equities and fixed income, such as momentum and macro and the other is alternative risk premia, which are mostly constructed to be market neutral.

As an example, sectors like financial services and energy typically exhibit negative exposure to bonds; they often outperform when bond prices fall. Similarly, the value factor has also demonstrated negative exposure to bonds. This understanding can be leveraged in an equity market neutral strategy, which uses these specific sectors and factors to create a diversified portfolio that includes both bonds and equities. It's crucial to acknowledge that these relationships, much like the stock-bond relationship, are dynamic and not fixed. Therefore, they require continuous monitoring, review, and risk management to ensure that the portfolio remains effectively positioned in response to changing market conditions.

Also, important to consider is a broad strategy to put these different strategies in a managed sleeve, which can further improve the diversification benefits of these strategies.

In conclusion, the evolving economic landscape presents substantial challenges and opportunities for portfolio construction. The key takeaway for investors is the need for an expanded and versatile toolkit. As traditional relationships between asset classes, such as stocks and bonds, undergo shifts, it becomes imperative to seek out assets that enhance portfolio diversification without introducing additional risks. Navigating this new environment requires a strategic approach, one that embraces a broader range of assets and a dynamic perspective on market correlations. By doing so, investors can better position their portfolios to withstand and capitalize on the changing tides of the global economy. This proactive, adaptable mindset is essential for achieving sustained success in the increasingly complex world of investment.